Some recent questions on Australian inflation Key points The Australian inflation rate peaked in the December quarter but has been slower to decline than some global peers. While interest rate rises are helping to reduce inflation (especially as discretionary consumer spending slows), rises in domestic energy prices, a tight rental market and a lagged pick …

Uncategorized

How to monitor carried forward concessional contributions

You may be eligible to make concessional contributions that are greater than the annual cap if you haven’t fully used your concessional cap in an earlier year. This could help you to save even more for retirement, while also managing tax. What are concessional contributions? There are a number of ways you can contribute to …

How to help grow your money through compound interest

Earning interest on interest: learn how the power of compounding can send your savings rocketing. Key takeaways Compound interest enables you to earn interest on interest which is accumulated over time. The effect of compound interest becomes extremely powerful over a long timeframe as the amount of interest earned grows. Investing in your super is …

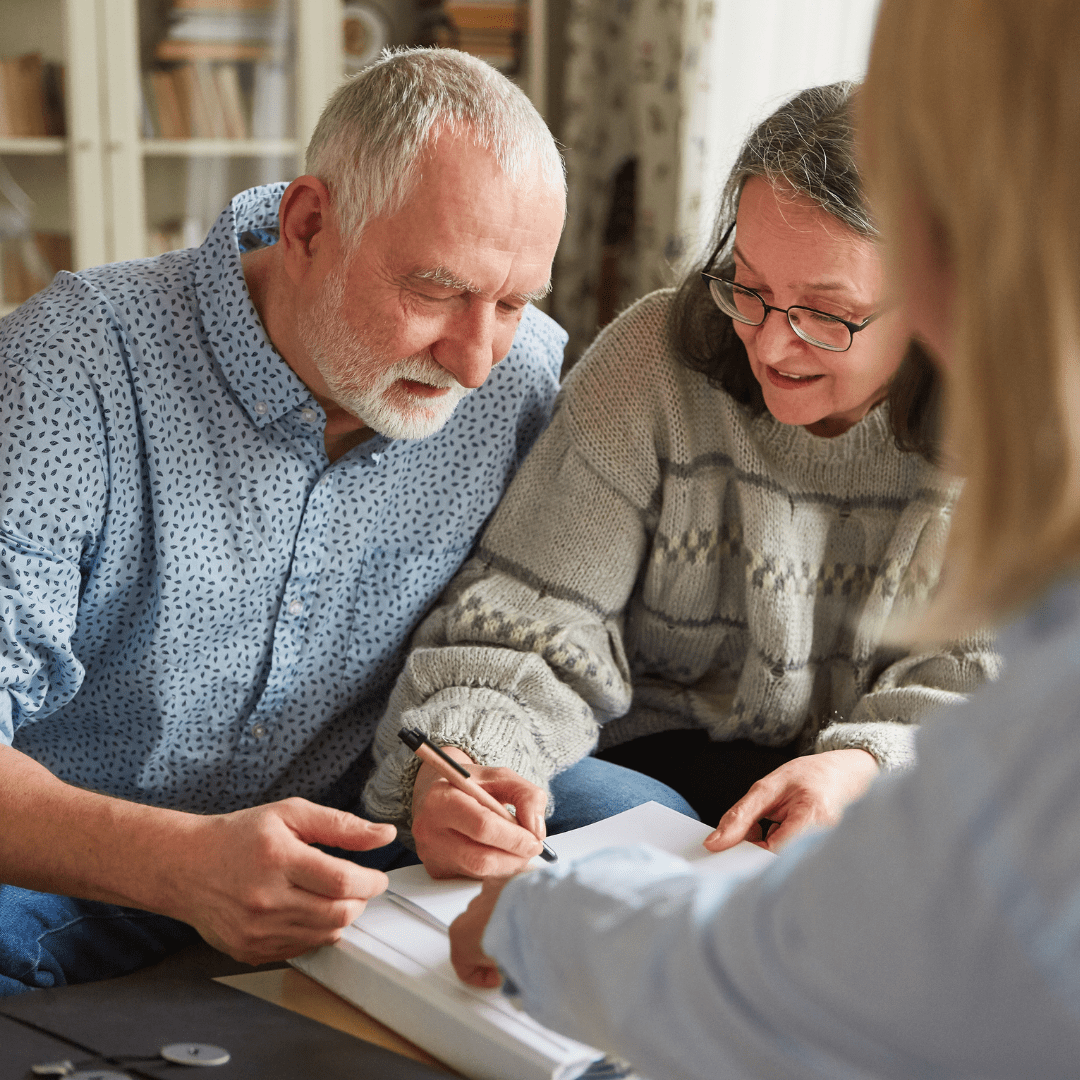

Granny flat arrangements within the context of the gifting rules

There are special rules for granny flat arrangements that may prevent the deprivation rules from applying. However they must satisfy a range of requirements. Retirees wanting to downsize their home may consider the option of living in a granny flat or an extension to / spare room of a relative or friend’s home. Money, the …

Economic update

July was a relatively uneventful month in financial markets and volatility remained low. Generally speaking, risk assets continued to perform well despite a sharp increase in the oil price. In fact July was the best month for oil since January 2022. Inflation seems to be coming off the boil in most key regions, reducing the …

Are you getting the Age Pension you’re entitled to?

If you receive the Age Pension, recent changes to means testing for retirees could put more money in your pocket. These changes impact the assessment of certain lifetime income streams that began on or after 1 July 2019 (including any that you take up now). Lifetime income streams There are two main types of lifetime …

Why do you need superannuation?

When you’re just starting out in the workforce, it’s easy to see superannuation as money that’s not quite yours. After all, if you’re focused on funding your lifestyle and saving for short term goals, retirement can seem a lifetime away; and seeing a chunk of your salary disappear into super every pay day can take …

More super for eligible employees from 1 July 2023

Compulsory super contributions paid by employers went up in July. Here are 8 things you should know, including what it could mean for your take home pay. Super contributions employers are required to make increased from 10.5% to 11% of an eligible employee’s before-tax salary or wages at the start of July. These contributions are …

How to get more from your 2023 tax return with super contributions

We all want to make the most of our tax return each year. Did you know, other than claiming the usual work related expenses, certain super contributions may also be tax deductible? If you’re looking at what deductions you might be able to claim this tax time, the good news is you may be able …

15 common sense tips to help manage your finances

Shop around We often shop around to get the best deal when it comes to consumer items but the same should always apply to services we get. It’s a highly competitive world out there and service companies want to get and keep your business. So when getting a new service – whether it be for …