How to invest responsibly and ethically

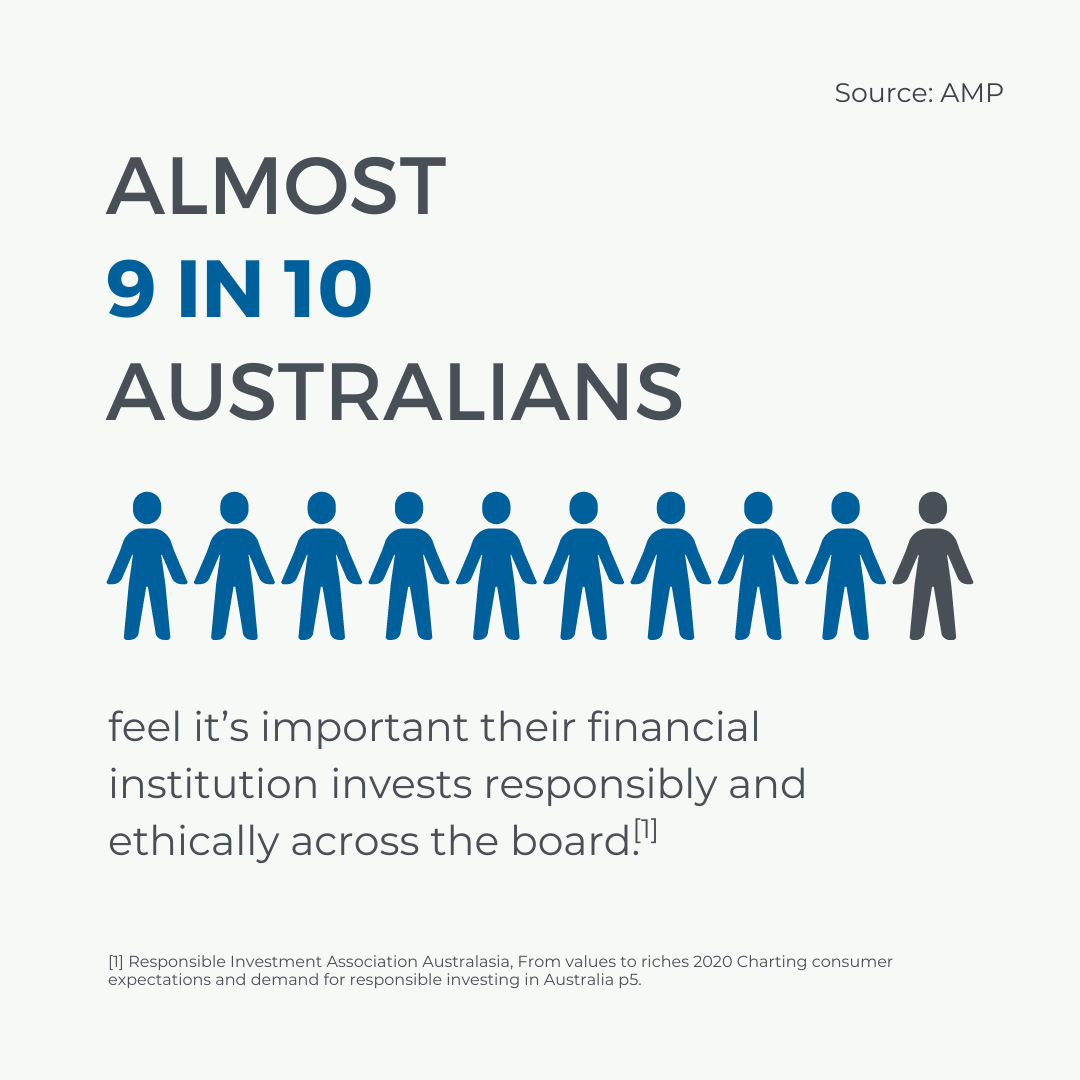

If you’d like your money to make a difference to the world as well as your future, responsible investing may be for you. Almost 9 in 10 (89%) Australians feel it’s important their financial institution invests responsibly and ethically across the board1. Ethical, social and governance (ESG) investments accounted for $1,281 billion, or 40%, of …