Key points

- A progress report on inflation: Inflation appears to have peaked, led by improvements in core goods prices and rate sensitive sectors like housing. The policy focus has shifted to labour market normalisation where early signs of progress are emerging.

- Is a soft landing in sight? The Fed remains committed to doing “whatever it takes” to bring inflation to the targeted level. Despite the aggressive tightening we’ve seen so far, alternative data indicators suggest that the economy remains on relatively solid footing.

- Equity market positioning: We are positioned for themes of continued high rates, improving sentiment outside the US and a potential soft economic landing. This is expressed with a preference for value particularly in cyclical sectors including capital goods, consumer durables, autos and airlines.

2022 was a year where extreme macroeconomic and geopolitical events shaped market behaviour. The US Consumer Price Index (CPI) peaked at 9.1%, the highest level in over 40 years. The subsequent policy response saw the US Federal Reserve (Fed) deliver 4.25% of rate hikes across only seven meetings. This was the fastest cycle of rate hikes since the early 1980s, a period of stubborn inflation and aggressive policy action that ultimately ended in a recession.

As we begin 2023, there’s a greater level of clarity around some of the questions that have driven markets over the last year. Recent inflationary data shows improvements in the trajectory of core goods prices and rate sensitive components. Now, the focus of policymakers has shifted towards restoring balance in the labour market and doing “whatever it takes” to bring inflation to the targeted level. As we enter a new phase of tightening beyond peak price pressures, what does alternative data reveal about the path of inflation and the recession that so many are expecting?

A progress report on inflation

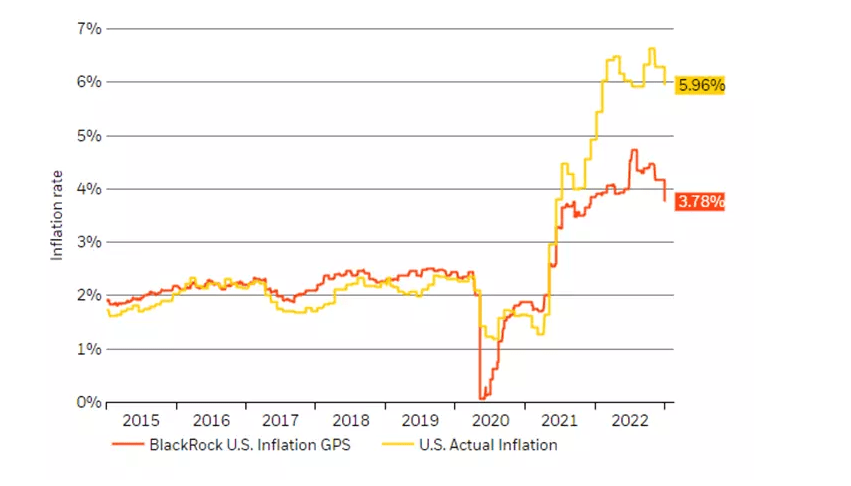

In the final months of 2022, long awaited improvements in the trajectory of inflation began to surface. Figure 1 shows the widening gap between current reported inflation and where US CPI is expected to stand in six months based on a broad range of leading economic indicators and text mined commentary on inflation. Peak inflation seems to be behind us and a clearer path towards meeting central bank objectives has started to appear. As observed in the inflation GPS measure, the sentiment of corporate comments around cost pressures and the effects of inflation on margins hasn’t showed signs of deteriorating as the outlook improves.

Figure 1: US Inflation GPS shows continued decline in the trajectory of consumer prices

Current US Inflation vs six month inflation expectations

Source: Refinitiv DataStream, chart by the BlackRock Investment Institute, December 2022. The BlackRock Inflation GPS shows where core (excluding food and energy) consumer price inflation may stand in six months’ time. The GPS models the relationship between rates of core inflation and a broad set of economic indicators including measures of slack, inflation expectations, and other inflation related data such as business surveys and wages. It also incorporates a proprietary Systematic Active Equity signal measured through text mining of commentary on inflation.

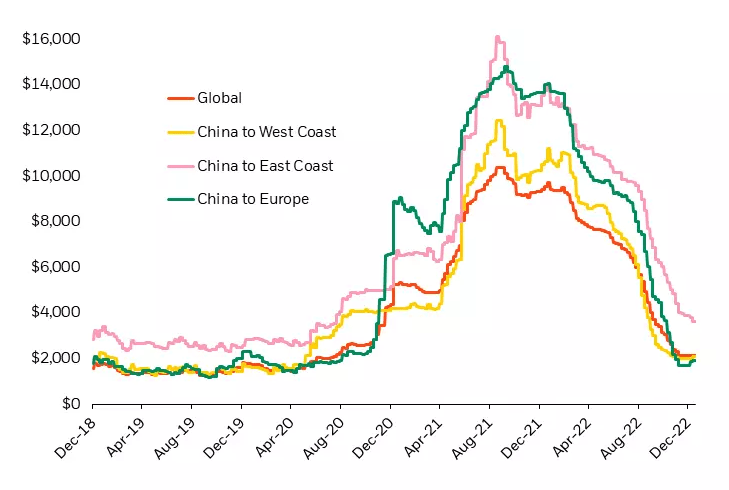

Core goods prices, where the initial surge in inflation was the most robust, are showing significant progress. This has continued to play out with the shift in spending from goods to services throughout the economic reopening and the healing of supply chain bottlenecks. Figure 2 shows average freight transportation costs which have fallen back to pre pandemic levels. These costs were previously 14 times greater during the peak of supply chain issues.

Figure 2: Global supply chains have mostly recovered with shipping costs returning to pre COVID levels

Average freight costs for shipping a 40ft container

Source: BlackRock, with data from Bloomberg, as of January 2023. All amounts in USD.

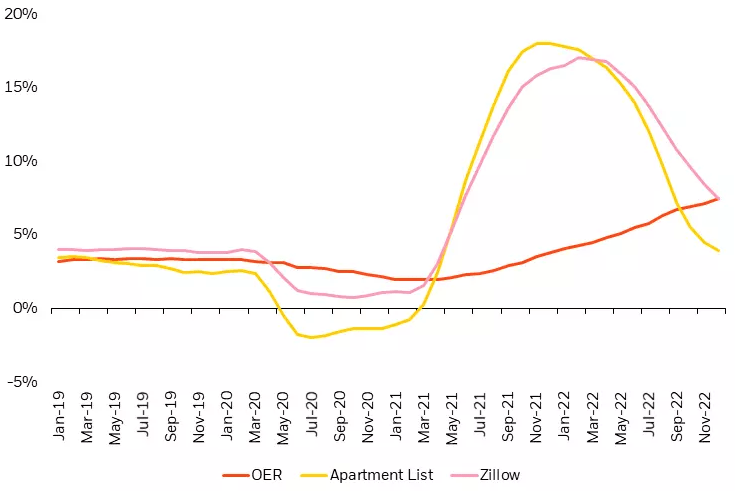

Shelter is another category where alternative data is pointing to a clear disinflationary trend throughout 2023. Shown in Figure 3, the growth rate of new online rental listings in the US has started to decline. The Owners’ Equivalent Rent (OER) component of CPI which captures both new and continuing leases tends to lag this alternative rental data by 6 to 9 months. This suggests that the trend we’re seeing in new leases will increasingly impact CPI data as the year goes on.

Figure 3: The growth rate of new rental leases has started to decline, a trend that will increasingly impact CPI data

Online new rental leases vs. Owners’ Equivalent Rent (OER)

Source: BlackRock, with data from Apartment List and Zillow, January 2023.

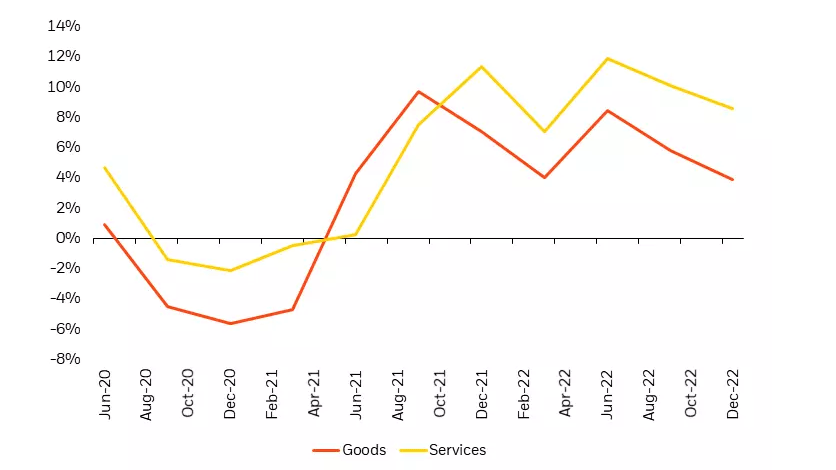

For the next phase of the tightening cycle, Fed officials have shifted their focus to labour markets. Wages have remained a persistent driver of broad-based services inflation since the economic reopening began. Historical periods of inflation have shown that reining in wage inflation is a critical step in restoring price stability and preventing long-run expectations from becoming unanchored. In early November, Fed Chairman Jerome Powell identified 3.5% wage growth as a targeted level that would be consistent with the Fed’s 2% inflation objective.

To monitor the trajectory of wage growth, we use online job postings in the US for a real time view of employment cost data ahead of official releases (Figure 4). Wage growth has started to moderate in recent months and shows signs that the labour market is finally beginning to cool. However, more progress is needed to reach the Fed’s target especially in the services sector where inflationary pressures remain the most stubborn.

Figure 4: Wage growth is showing signs of moderating, but more progress is needed

Year over year wage growth for goods vs services roles

Source: BlackRock, with data from Burning Glass Technologies, as of January 2023.

Is a soft landing in sight?

The likelihood of a soft vs hard landing depends on how healthy the economy remains as inflation continues to normalize and how policymakers react to ongoing developments. So what does the data tell us about where the economy is heading?

Let’s first examine the underlying drivers of the readjustment that’s taking place in labour markets. Following COVID-19, a labour shortage emerged as many individuals didn’t immediately return to the workforce. Simultaneously, the economic reopening drove robust demand for workers and a significant increase in job openings, many of which remained vacant due to labour supply constraints. As a result, the recent normalisation in labour markets and wages has mostly come from a decrease in job openings. This differs from past periods of inflation where monetary tightening caused severe job losses and high unemployment that ultimately ended in a recession.

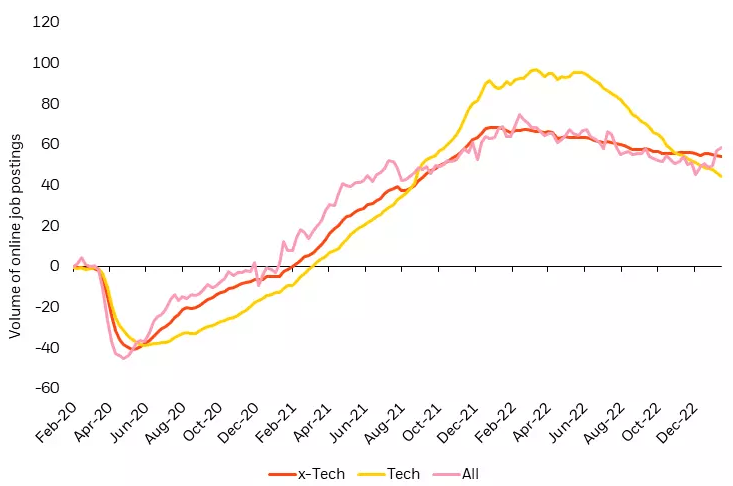

Figure 5 shows the decline that we’ve seen in the number of online job postings as labour demand falls. Most of the pullback in job postings is concentrated in the technology sector. This is also the case for layoffs which remain extremely benign across the broader economy. Importantly, job openings remain elevated in aggregate relative to pre COVID, suggesting that the gap between labour demand and supply can continue to narrow through a decline in job openings rather than severe layoffs.

Figure 5: Falling labour demand has come through declines in job openings, not layoffs

Volume of online job postings normalised to 2020 levels

Source: BlackRock, with data from Indeed.com, as of January 2023.

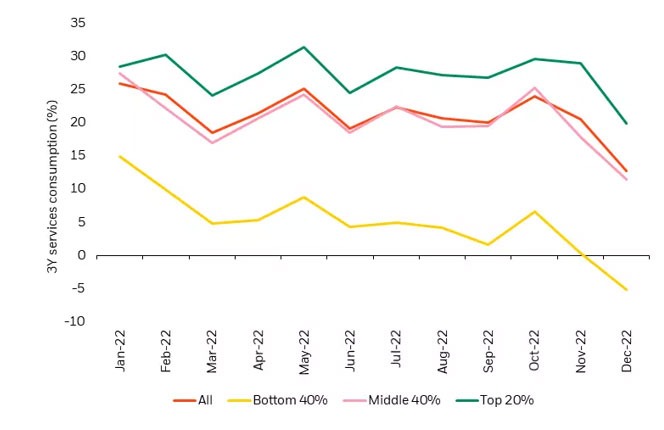

Along with company behaviour, we’re closely monitoring consumer activity for signs of weakness. Figure 6 shows US inflation adjusted consumer spending in the services sector which remains relatively stable and above pre COVID levels despite starting to decline particularly for the lowest income cohort. How has this level of consumer activity been sustainable as savings rates have fallen to historical lows amid higher interest rates? The previous period of unprecedented fiscal stimulus throughout the pandemic has kept the total level of household savings in excess, even long after stimulus payments have tapered off. Furthermore, household interest payments remain well below the pre COVID trend with less debt on consumer balance sheets. The combination of sustained excess savings, lower debt levels, and muted layoff activity has allowed consumer spending to remain relatively resilient over the course of the Fed’s tightening cycle.

Figure 6: US Services spending remains above 2019 levels despite signs of weakness

3Y Discretionary service consumption by income cohort adjusted for inflation

Source: BlackRock, Yodlee/ConsumerEdge, Earnest Research, as of December 2022.

Alternative data reveals an improving picture for inflation, orderly rebalancing of the labour market and a relatively healthy consumer – each currently more supportive of the case for a soft landing than a hard landing.

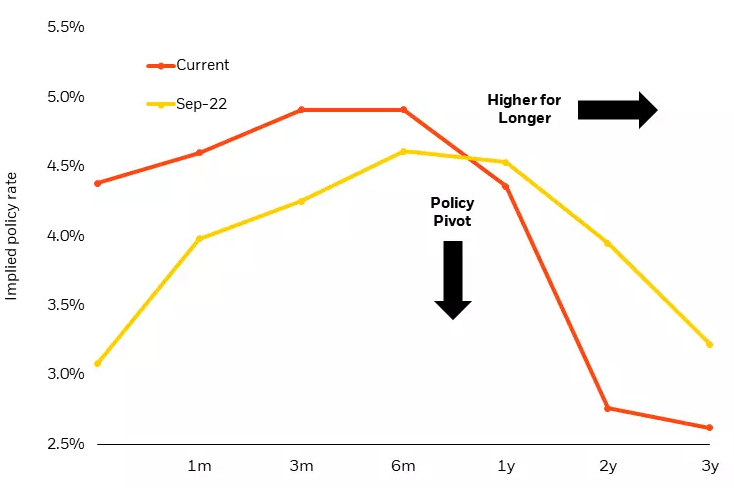

Market pricing has increasingly shifted towards the expectation for interest rate cuts by the end of 2023 (Figure 7). This can be supported by two opposing viewpoints: 1) the hard landing scenario which expects policymakers to overtighten and engineer a recession, or 2) a scenario where inflation swiftly returns to the 2% target and the Fed is able to begin easing financial conditions. In our view, both of these scenarios are unrealistic. Instead, we believe rates will remain higher for longer rather than a near term policy pivot. Today’s relatively stable economy may remain more resilient to high rates and policymakers are likely to delay easing financial conditions due to the lingering effects of two years of excessive inflation.

Figure 7: Market is currently pricing in rate cuts by the end of 2023

Market implied policy rates

Source: BlackRock, with data from Bloomberg, as of January 19, 2023.

Equity market positioning for Q1, 2023

After a challenging year for equity markets in 2022, the downward trajectory of inflation and continued economic stability point to a slightly more positive outlook in the coming months. How are these insights shaping our positioning across the global equity landscape?

An expanding global opportunity set

Like the US, the outlook for Europe has started to improve despite core inflation remaining at record highs. A warmer than expected winter has relieved some of the pressure from the energy crisis. Wage growth has also started to come down in Europe as labour markets normalise at an even faster pace than in the US. In China, the economic reopening has quickly taken off. Along with relaxed COVID-19 restrictions, there’s been an easing in common prosperity and antimonopoly regulations. This is an added tailwind to the improving sentiment towards Chinese assets, particularly in sectors like education, internet and real estate that were most impacted by these regulatory initiatives.

Sector positioning for a potential soft landing

Our global portfolios maintain a preference for value vs growth based on continued themes of high rates and inflation followed by a potential soft landing. Notably, we’ve seen a shift in the underlying sectors driving the top down leadership of value. What was previously led by the energy sector has shifted to favour cyclical sectors that have been heavily discounted over the last year, including capital goods, consumer durables, autos and airlines where we’re currently overweight. These are well positioned for a continued high interest rate environment where the economy ultimately avoids a deep recession.

Conclusion

As we enter the next phase in the fight against inflation, market focus has shifted to whether policymakers can achieve a durable decline in inflation without causing a recession. Using alternative data to cut through the noise of hard vs soft landing speculation, we see signs of progress in restoring price stability while maintaining economic strength. At the same time, macroeconomic uncertainty remains high and we expect market volatility to persist as conditions evolve. This makes a data centric investment approach crucial to navigating today’s complex environment, allowing us to remain nimble as investors during a time where dynamism matters most.

Source: BlackRock